Labor markets in the Middle East: Analyzing trends and opportunities in 2024

In 2024, the labor markets in Middle Eastern countries such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates represent crucial sectors of their economies, mirroring and adapting to global and regional economic fluctuations, labor regulations, and migration policies. These markets are notably influenced by various socio-economic factors, government policies, and especially by the distinct characteristics of the kafala sponsorship system. This system, which predominantly governs labor migration and employment practices in these nations, has specific impacts. For instance, it ties the legal status of migrant workers to their employers, affecting their mobility and rights within the labor market.

Amidst ongoing reforms, the kafala system continues to shape the labor environment in the Middle East significantly. For instance, in recent years leading up to 2024, Saudi Arabia has been at the forefront of significant labor reform initiatives to improve the kafala system. These reforms have a direct impact on over 10 million foreign workers. Similarly, Qatar has also implemented significant reforms to its labor laws, particularly before the 2022 FIFA World Cup. These reforms included the introduction of a minimum wage and eliminating the requirement for migrant workers to obtain exit permits, marking a significant shift in the labor market.

The economic contribution of expatriate workers in the Gulf Cooperation Council (GCC) states is substantial and pivotal to the functioning of these economies. They constitute a significant workforce and play a crucial role in various sectors. For example, in the UAE, expatriates comprise over 80% of the population and are critical in construction, hospitality, and services. In Qatar, migrant workers account for over 90% of the workforce, highlighting their indispensable role in the labor market.

Furthermore, these countries’ labor participation rates and unemployment figures reflect varied economic dynamics. For instance, Saudi Arabia has been working to lower its unemployment rate, which stood at approximately 11% in 2023, by implementing various initiatives under its Vision 2030 program aimed at economic diversification and job creation for nationals. Meanwhile, countries like the UAE maintain relatively lower unemployment rates, buoyed by robust economic diversification strategies and a significant influx of foreign labor.

These dynamics underscore the complex interplay between labor market forces and regulatory frameworks in the Middle East, demonstrating how these markets are intricately tied to broader socio-economic and policy fields.

We’ll discuss this in detail below. First, let’s examine the labor market in some leading industries.

What’s happening in the different industries in Gulf countries

An analysis of the labor market in the Gulf Cooperation Council (GCC) countries shows diverse dynamics in different sectors. Of course, the Kafala system, a sponsorship framework crucial to the region’s labor market, has had a significant impact on labor dynamics, especially regarding migrant workers. The private sector’s dependence on cheap migrant labor, particularly in the construction, hospitality, and transport industries, has established certain expectations among citizens and employers about the nature of work considered acceptable for citizens and not migrants.

While oil and gas remain significant, there is an emphasis on building a competitive technology ecosystem and boosting sectors like Islamic banking and tourism, especially in places like Oman, Saudi Arabia, and the UAE.

In a more specific sector, Saudi Arabia plans to create up to 250,000 new jobs by 2030, focusing on developing its tourism sector to increase its contribution to GDP significantly. This move indicates a strategic shift toward diversifying the economy, reducing dependence on oil, and creating new jobs for citizens.

The energy and oil industries

These industries in the Middle East continue to play a key role globally, with significant activities in oilfield services. For instance, contracts awarded by Abu Dhabi National Oil Company (ADNOC) to increase production capacity indicate ongoing investment in the energy sector. Similarly, agreements between Weatherford International and Saudi Aramco underscore the importance of the oil and gas industry in the region, reflecting an active market with ongoing demand for oilfield services.

In the context of broader economic strategies, Saudi Arabia, in line with its Vision 2030 plan, seeks to diversify its economy to avoid oil dependence. It includes stimulating non-oil sectors of the economy, such as tourism and hospitality, through significant investment in infrastructure and local industries. Saudi Arabia’s financial strategies include emphasizing domestic growth and supporting non-oil sectors of GDP despite fluctuating oil revenues.

Energy sector

The Middle East’s strategic shift towards sustainable development, in anticipation of COP28, clearly illustrates the region’s commitment to environmental responsibility. Countries like the UAE, Saudi Arabia, Oman, and Bahrain have set ambitious net-zero carbon targets. These initiatives impact the energy sector and potentially influence labor markets as they pave the way for new skills and job opportunities in renewable energy and sustainable practices.

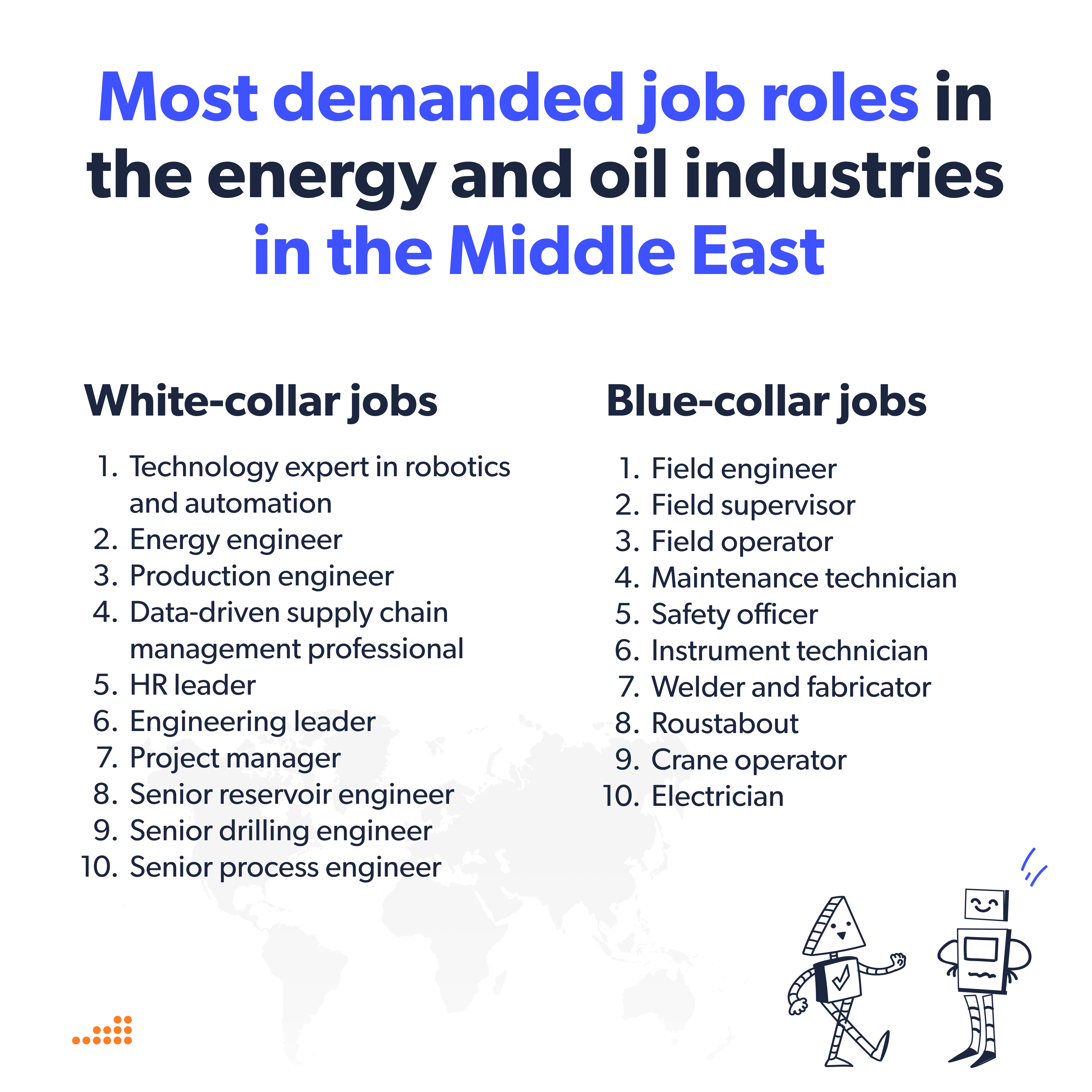

10 most demanded job roles in the energy and oil industries in the Middle East

The top 10 most demanded job roles in the energy and oil industries in the Middle East, specifically in the UAE for 2024, include a range of engineering, management, and technical positions reflecting the industry’s focus on innovation, efficiency, and environmental considerations. These roles, along with their monthly salary ranges in UAE Dirhams (Dh), are:

- Technology expert in robotics and automation

- Energy engineer

- Production engineer

- Data-driven supply chain management professional

- HR leader

- Engineering leader

- Project manager

- Senior reservoir engineer

- Senior drilling engineer

- Senior process engineer

Construction industry

The Middle East’s construction industry is not just experiencing substantial growth and transformation, but it’s also grappling with unique challenges that vary across different countries. For instance, Saudi Arabia strives to adopt sustainable construction practices and attract international expertise to fuel its growth. Adopting technologies like building information modeling BIM is rising, boosting efficiency and planning. However, the industry is not without its share of common hurdles:

- Skilled labor shortage. There’s a critical demand for skilled professionals in engineering, architecture, and construction trades across the region.

- Infrastructure needs. Many countries require substantial investments in basic infrastructure like roads and utilities to support further development.

- Financing. Securing funding for large-scale construction projects is challenging, necessitating innovative approaches like PPPs.

Considering the information from the HRForecast report “Future job roles and skills in Norwegian construction,” the future of the construction sector is increasingly linked to technological progress and skills development. Like its Middle Eastern counterparts, the Norwegian construction industry recognizes the importance of investing in human capital and technology to remain competitive.

Despite its smaller size, Jordan’s construction sector is a powerhouse for its economy, making significant contributions to the GDP and employment. The country boasts a robust domestic construction scene and exports materials globally, showcasing its competitive edge. The Jordan Build trade fair in Amman is a game-changer for the Middle East’s construction industry, serving as a hub for innovation, investment, and collaboration. It exhibits the latest construction technology, fosters partnerships, attracts investment, and facilitates knowledge sharing, playing a key role in the region’s construction industry and economic advancement.

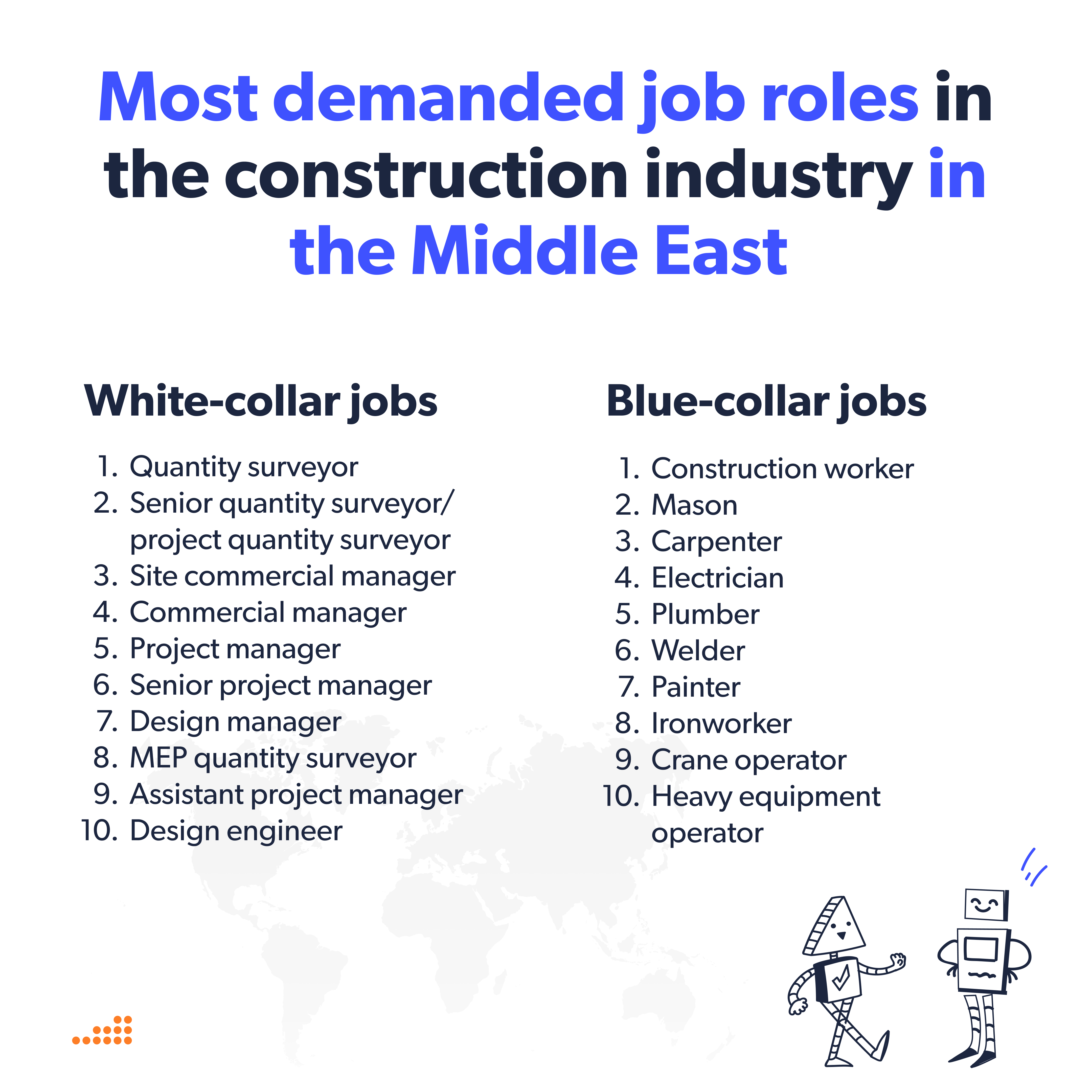

10 most demanded job roles in the construction industry in the Middle East

Based on the recent job listings and industry insights from Bayt.com and Maxim Recruitment, the most demanded job roles in the Middle East construction industry in 2024 include a variety of positions across different sectors of construction.

- Construction worker

- Quantity surveyor

- Senior quantity surveyor / project quantity surveyor

- Site commercial manager

- Contracts advisor

- MEP quantity surveyor

- Commercial manager

- Project manager

- Senior project manager

- Design manager

Aviation industry

The Middle East aviation market is projected to grow from USD 64.31 billion in 2024 to USD 74.15 billion by 2029 at a 2.89% CAGR.

Learn about the future of the aviation workforce, including changing roles and emerging trends. Find out how the working environment around the world has changed and how it has affected the aviation sector.

The aviation sector in the Middle East has undergone significant transformations, with major players like Airbus, Boeing, and Lockheed Martin making their mark. Recent developments include substantial aircraft orders from airlines such as Qatar Airways and strategic agreements like the UAE’s acquisition of F-35 jets. Moreover, the emergence of cargo airlines underscores the region’s increasing focus on logistics and connectivity between Asia and the Middle East.

While the commercial aviation sector faces challenges and transformations, the industry’s diversification — spanning full-service airlines, budget carriers, and general and military aviation — presents varied implications for the workforce. Adaptation to new market realities, evolving skill requirements, and the potential for sector-specific growth will shape the employment situation in the Middle East aviation industry.

Despite each country and industry having unique prospects and challenges, the Middle East is witnessing a general trend toward diversification and growth across key sectors. Policymakers and businesses strategically focus on sustainable development, expanding beyond traditional sectors to embrace technology, tourism, and advanced manufacturing. This shift aims to create a more resilient and diversified economic industry, underscoring the region’s adaptability and resilience.

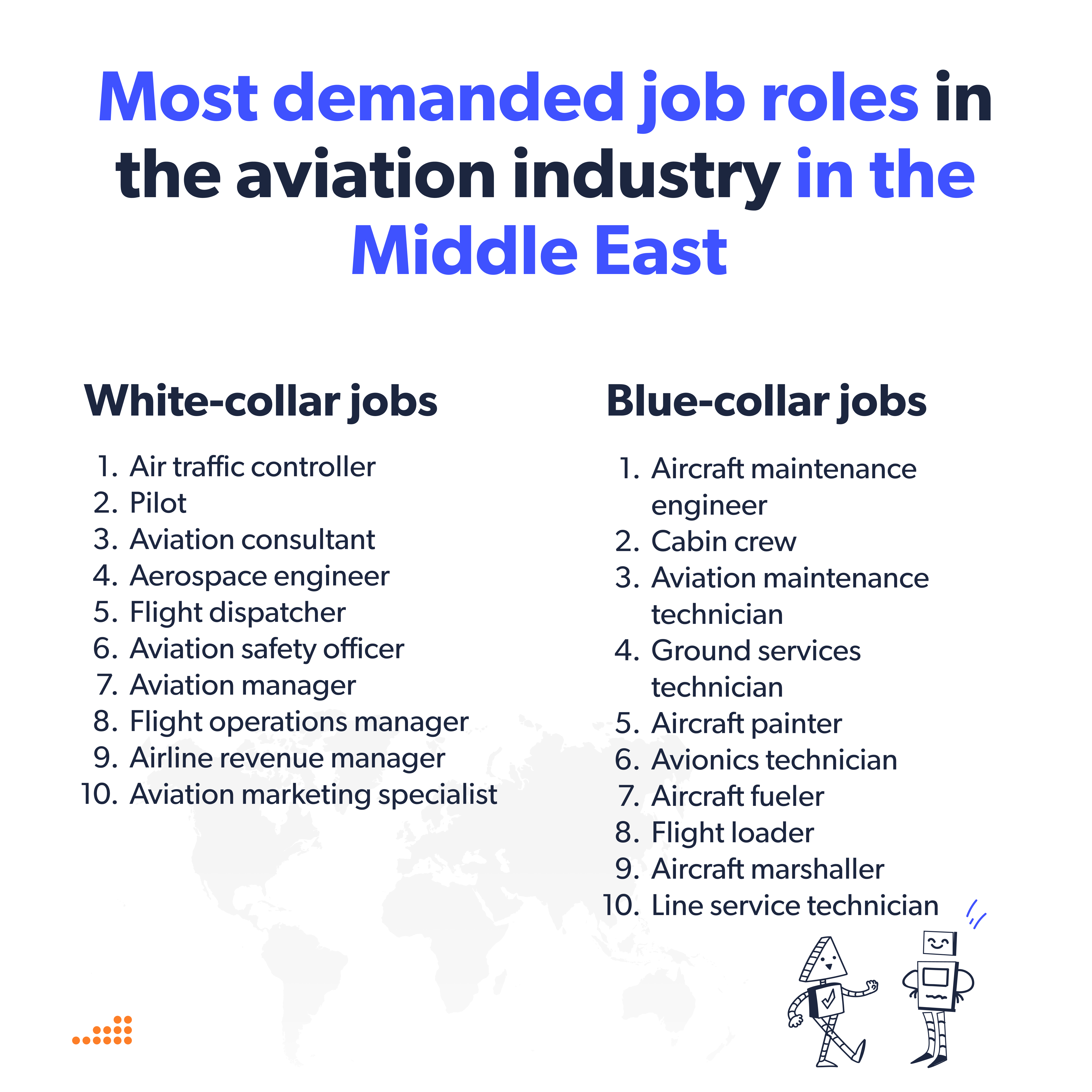

10 most demanded job roles in the aviation industry in the Middle East

Based on the information gathered, here are the top 10 most demanded job roles in the aviation industry in the Middle East in 2024:

- Cabin crew

- Pilot

- Aircraft maintenance engineer

- Aviation maintenance officer

- Quality assurance engineer

- Flight attendant

- Air traffic controller

- Aerospace engineer

- Airport service agent

- Aircraft engineering technology instructor

Chemical industry

The chemical industry in the Middle East is undergoing substantial transformation and expansion, driven by various factors and trends. A key trend is the industry’s heightened emphasis on digitization and artificial intelligence (AI). The sector views investments in digital technology and AI as critical to its future, enhancing productivity, fostering innovation, refining decision-making, and strengthening customer relationships. Despite a minor setback in digital investment in 2023, the industry is projected to bounce back, leveraging AI for research and development, process optimization, and discovering new uses for existing products.

Regarding regional development, Kuwait, Saudi Arabia, and the UAE are leading the way with new “mega” petrochemical projects, indicating strong growth and investment in the sector.

These projects are designed to increase the region’s capacity and capabilities in chemical production, positioning it for the world market.

Furthermore, the Middle East chemical industry is set for a faster growth trajectory than other regional sectors. This is attributed to strategic investments and the expansion of exports, especially in key markets such as China. Technological advancements and the shift towards higher-value chemical production further fuel this growth, positioning the industry for global competitiveness.

Despite these positive trends, there are challenges ahead. Saudi Basic Industries Corporation (SABIC)’s CEO predicted a challenging year for the chemical industry in 2024, hinting at the complexities and uncertainties the sector may face.

While the Middle East chemical industry is poised for growth and transformation, thanks to technological advancements and significant investment, it should also navigate potential challenges and market dynamics. Check out what the demand for jobs and skills directly related to sustainability is developing within the chemical industry. See what you can learn about your industry according to your location.

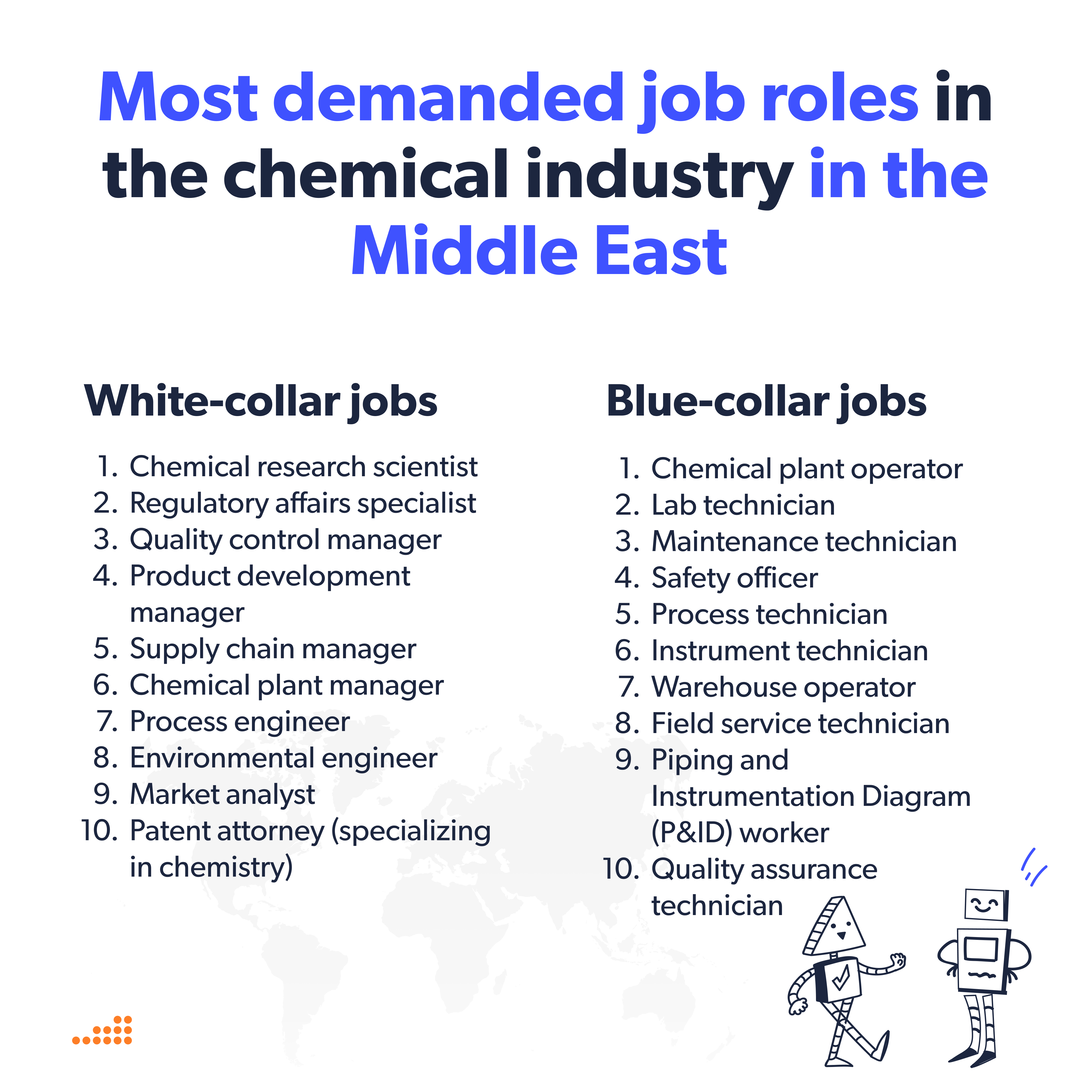

10 most demanded job roles in the chemical industry in the Middle East

Based on the information gathered from the chemical industry trends and recent job listings, here are ten job roles that could be in high demand within the Middle East’s chemical industry:

- Chief Scientist, Research, Development, and Innovation (RD&I) center

- Health, Safety, and Environment (HSE) engineer

- Sales Engineer

- Maintenance mechanic – plumbing

- Engineering manager

- Process control systems specialist

- Deputy material manager

- Specification engineer

- Senior maintenance engineer – instrumentation & controls

- Water treatment engineer

Hospitality and tourism

In 2024, the hospitality and tourism industry in the Middle East is growing and booming with significant growth and innovation. The scale of these developments is staggering, with new resorts like the Four Seasons at Triple Bay AMAALA and unique projects like NEOM’s Gidori featuring 200 exclusive villas. Saudi Arabia’s $11.2 billion tourism initiative alone is creating 120,000 jobs, and they’re also opening heritage hotels in Jeddah’s Historic District. The UAE aims to welcome 140 million passengers through its airports, and Egypt reported a 6% increase in tourist arrivals. Oman is planning a $2.4 billion mountain destination, indicating robust regional investment in tourism infrastructure.

These efforts are instrumental in enhancing the region’s appeal as a premier travel destination and contributing significantly to its economic diversification and employment generation, positioning the Middle East at the forefront of global tourism.

10 most demanded job roles in the hospitality and tourism industry in the Middle East

The hospitality and tourism industries in the Middle East are undergoing significant transformations and growth, driven by technological advancements, demographic shifts, and economic development strategies. While specific job roles in high demand for 2024 aren’t listed explicitly in the sources I accessed, we can infer the types of roles that would likely be in demand based on industry trends and regional developments:

- Digital transformation specialists

- Sustainability managers

- Tourism marketing specialists

- Hospitality management

- Event planners and managers

- Customer experience managers

- Cultural heritage tourism experts

- Health and wellness tourism professionals

- Adventure tourism specialists

- Travel tech developers

HRForecast as a workforce and business partner

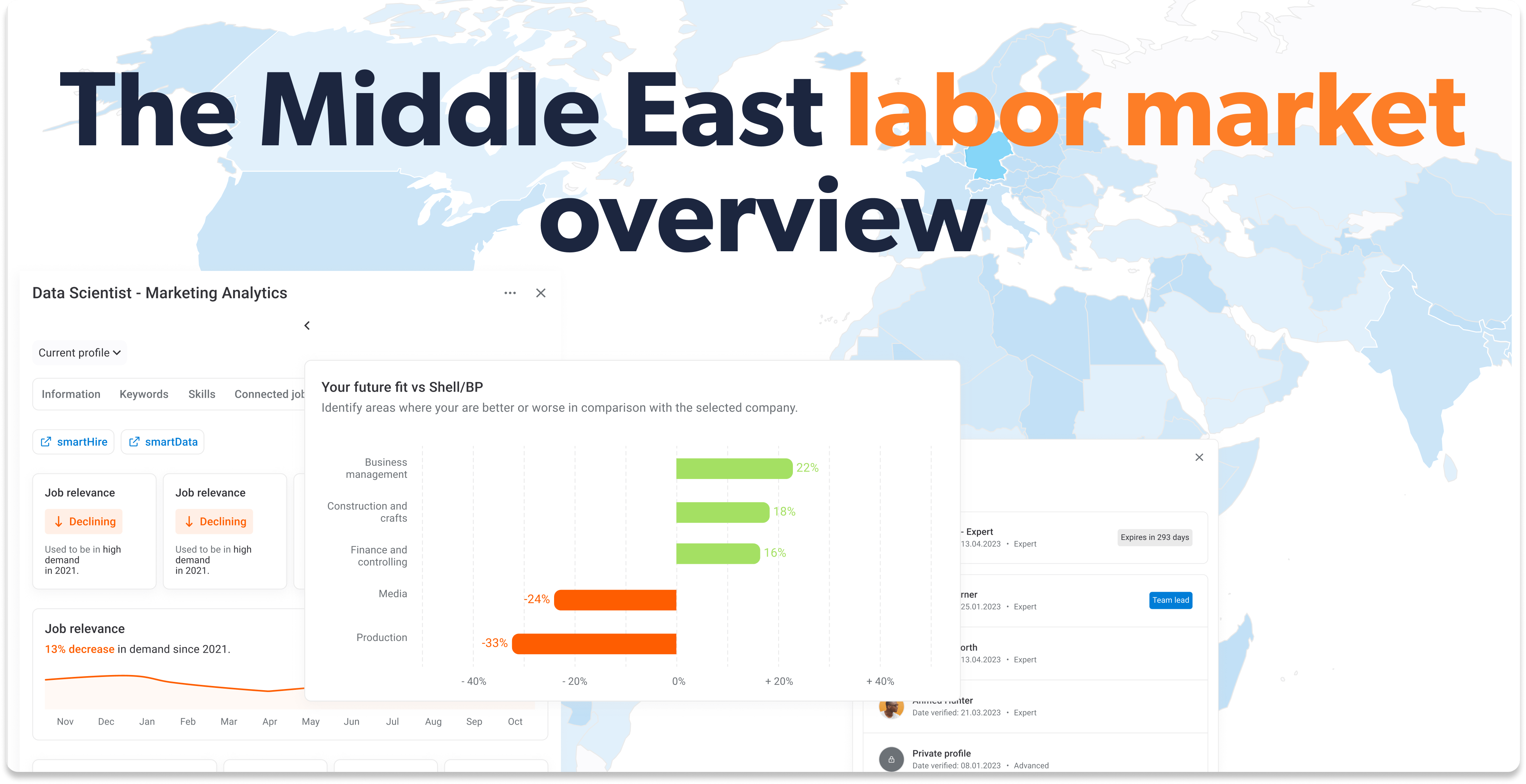

HRForecast is a key business and workforce partner, offering advanced analytics and strategic insights to transform how industries anticipate and manage human resources challenges. We’ve worked with companies like Siemens, Deutsche Bahn, Lufthansa, Continental, and Merck KGaA by providing innovative applications and data analytics services. We focus on analyzing global market data and strategically planning the workforce. These initiatives address current labor market dynamics and prepare organizations for future changes, helping to create a more adaptive, skilled, and inclusive workforce.

To tie in HRForecast’s potential contributions:

smartData for data-driven insights

HRForecast can provide advanced analytics and predictive modeling to help these industries understand labor market trends, identify skill gaps, and forecast future workforce needs.

For example, HRForecast implemented predictive modeling solutions for Stadtwerke Düsseldorf, a municipal utility company in Germany, tackling various HR challenges. They efficiently planned the spatial distribution for a new head office, identifying potential savings and optimal space usage. Additionally, the HRForecast performed strategic workforce planning, translating business scenarios into workforce requirements to mitigate risks. The predictive modeling also forecasted labor market trends for specific apprenticeships, aiding recruitment and workforce planning.

smartPlan for strategic workforce planning

HRForecast can assist organizations in developing long-term strategies to adapt to market changes, reduce dependency on expatriate labor, and cultivate local talent.

- For CMS (law and tax company), HRForecast developed a strategic workforce architecture model, identifying key roles and establishing recruitment and development goals to enhance strategic alignment.

- Kramp (a company that manufactures spare parts and accessories for the agricultural industry) benefited from HRForecast’s optimization of workforce planning, integration of external market data to refine recruitment strategies and workforce distribution, and addressing regional skill shortages.

- HanseWasser (responsible for the wastewater disposal in Bremen) leveraged HRForecast’s big data analytics for long-term planning, identifying future competency gaps, and optimizing recruiting strategies to ensure sustainable workforce development amidst significant retirements.

Future job profiles for enhancing HR practices

HRForecast can offer solutions to improve HR practices, focusing on diversity, equity, and inclusion, particularly within the context of the kafala system.

For example, HRForecast enhanced Wacker Chemie AG’s HR practices by identifying future job profiles and labor market trends, aiding strategic workforce planning. Additionally, for BASF (one of the largest chemical producers in Europe), HRForecast developed a model to predict gender diversity outcomes, enabling targeted initiatives to improve gender balance. These examples demonstrate HRForecast’s capability to leverage data analytics to inform and improve HR strategies, particularly in areas like diversity and inclusion.

smartPeople for learning and development

HRForecast can facilitate upskilling and reskilling programs, aligning workforce capabilities with industry demands, especially in technology and renewable energy sectors.

A1 (a leading telecommunications company in Central and Eastern Europe) implemented AI-driven learning experiences, offering personalized learning pathways to enhance employee development. For Deutsche Telekom, HRForecast helped develop AI-powered learning journeys that align with individual skills and business needs and foster continuous learning and development in technology-focused areas.

How can HRForecast provide specific benefits for businesses in Gulf countries?

HRForecast can significantly benefit businesses in the Gulf countries by leveraging its expertise in advanced analytics and strategic workforce planning.

We offer analysis of local labor market dynamics and industry trends, helping Gulf businesses optimize workforce allocation, competitor analysis locally and internationally employee skills with strategic needs, and anticipate future workforce needs.

In addition, HRForecast supports the development of inclusive HR practices to serve the region’s diverse workforce, improves strategic workforce planning, and facilitates skills development and talent management. By providing these services, HRForecast helps companies in the Gulf achieve competitive advantage, improve employee engagement and retention, and improve overall business performance.

To find out how HRForecast can benefit your organization, book a call with our experts to discuss customized solutions tailored to your needs.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810