Insurance industry workforce evolution: Meeting challenges head-on

In the not-so-distant past, the insurance industry exuded a palpable sense of tradition, marked by in-person meetings and mountains of paperwork. However, the onset of the COVID-19 pandemic brought about an abrupt about-face, swiftly transitioning office-based operations to remote setups.

A striking case in point is the USAA Life Insurance Company, where 90% of their vast 35,000-strong workforce was firmly rooted in office spaces, even retaining the practice of in-person medical exams for insurance underwriting. The industry undertook a radical makeover in response to the pandemic, leading to a substantial shift towards remote work. USAA itself transitioned to a 98% remote workforce.

Fast forward to the present day, the insurance landscape has morphed into a digitized realm. This transformation has ushered in a unique set of workforce challenges, primarily a growing talent deficit.

Insurance industry transformation and workforce challenges

The insurance industry, a fortress of the financial world, currently grapples with an unprecedented workforce challenge that can only be described as a crisis of epic proportions. The sector finds itself at a crossroads, grappling with unprecedented workforce challenges that can only be described as a crisis of epic proportions.

A severe talent shortage looms large, with countless positions remaining unfilled. According to Insurance Newsnet, the industry has seen a dramatic decline in total employment in just two short years, shedding a staggering 85,000 jobs, effectively diminishing its once-mighty workforce from 1.56 million. This dire situation has reached a critical juncture, with a recent survey revealing a jaw-dropping 10-year low in layoffs and a remarkable 10-year high in voluntary departures from insurance roles.

These compelling factors underscore the urgent recruitment and retention challenges that dominate the contemporary insurance landscape.

Aging workforce

The insurance sector faces a unique challenge in acquiring top talent. A significant portion of its workforce either resides at or is rapidly approaching retirement age, ushering in a formidable challenge. Data from the U.S. Bureau of Labor Statistics indicate that nearly half a million insurance professionals are poised for retirement in the coming years. This impending wave of retirements compounds the industry’s already pressing talent shortage.

Furthermore, attracting early- and mid-career professionals to the insurance field presents a formidable hurdle. A mere 4% of millennials, projected to constitute 75% of the national workforce by 2025, express interest in pursuing careers in insurance.

This conundrum has sparked a sense of urgency within the industry to retrain and retain the Baby Boomer generation, a demographic brimming with irreplaceable institutional knowledge and extensive industry experience. By preserving the insights and wisdom of this generation, the insurance sector can bolster its resilience and success in the face of these formidable workforce challenges.

Hiring, talent attraction, and retention challenges

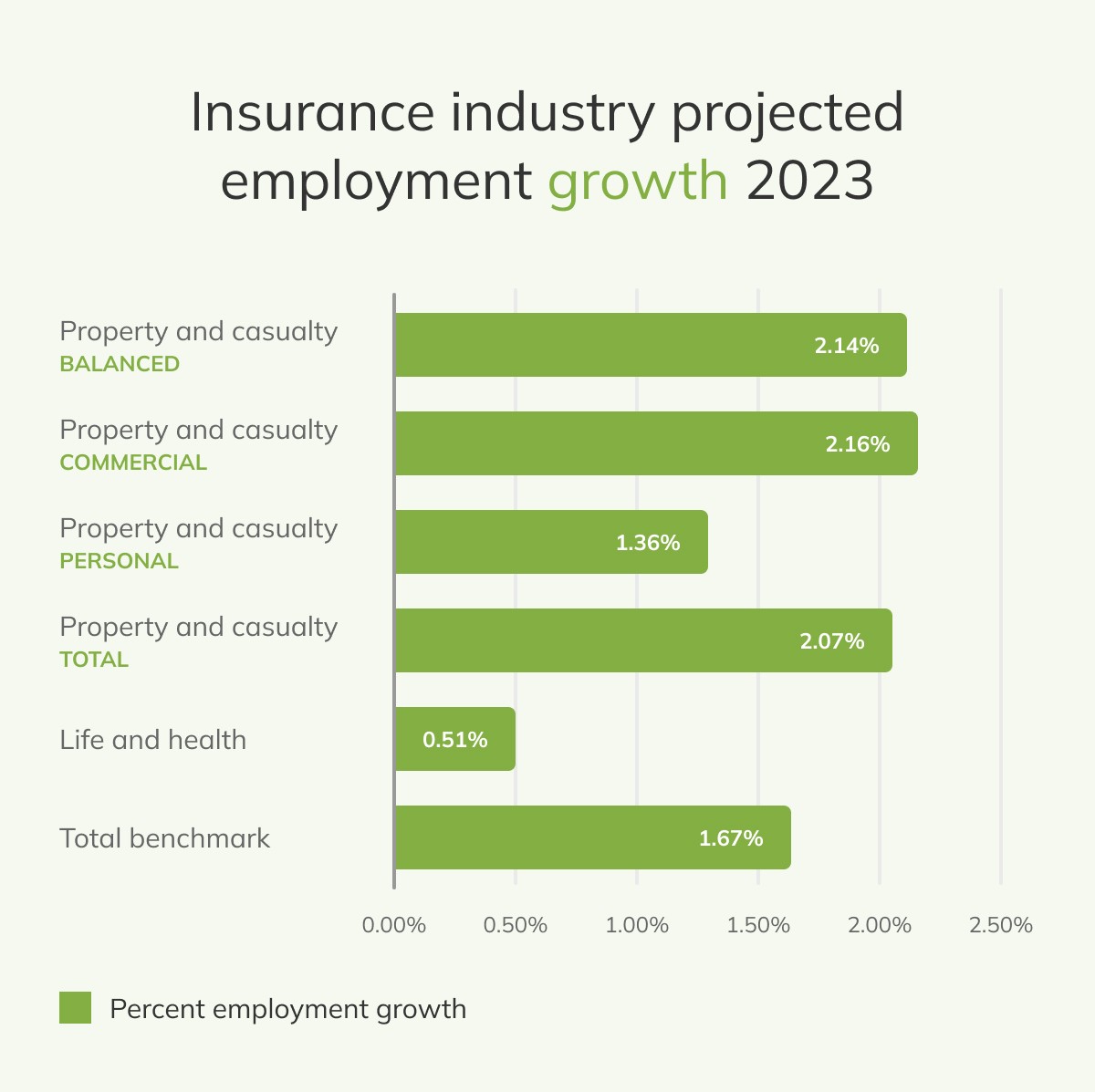

Like many others, the insurance industry faced significant challenges during the pandemic. While employment in the sector did rise by 1.83% last year, it fell short of the projected numbers, and the industry has not fully recovered to its pre-pandemic employment levels. At the end of the year, there were approximately 386,000 open positions within the insurance sector, according to a study conducted by Ward Benchmarking and the Jacobson Group. These organizations specialize in analyzing employment and compensation trends and providing recruitment services.

One of the prominent challenges for insurance companies has been the difficulty in keeping up with workforce turnover, primarily due to retirements and employees transitioning to alternative employers. According to Jacobson, this trend has persisted despite rising wages, with average industry merit pay increases at about 4% last year. However, the federal Bureau of Labor Statistics reported higher pay hikes of about 6% within the insurance sector, highlighting that employees often receive more substantial increases when switching to different companies.

Employee turnover in the insurance sector reached 14.7% last year, although it slowed down in the second half of the year as economic uncertainty increased. Most of this turnover was voluntary, indicating that employees were actively seeking opportunities elsewhere.

According to a study by The Jacobson Group and Ward, part of Aon plc (NYSE: AON), the insurance industry faces a competitive talent landscape, with 25% of companies finding it increasingly challenging to hire talent compared to the previous year, many insurance firms are optimistic about growth prospects. 67% of insurance companies plan to expand their workforce over the next 12 months, reflecting their confidence in industry growth.

Source: Wizehire

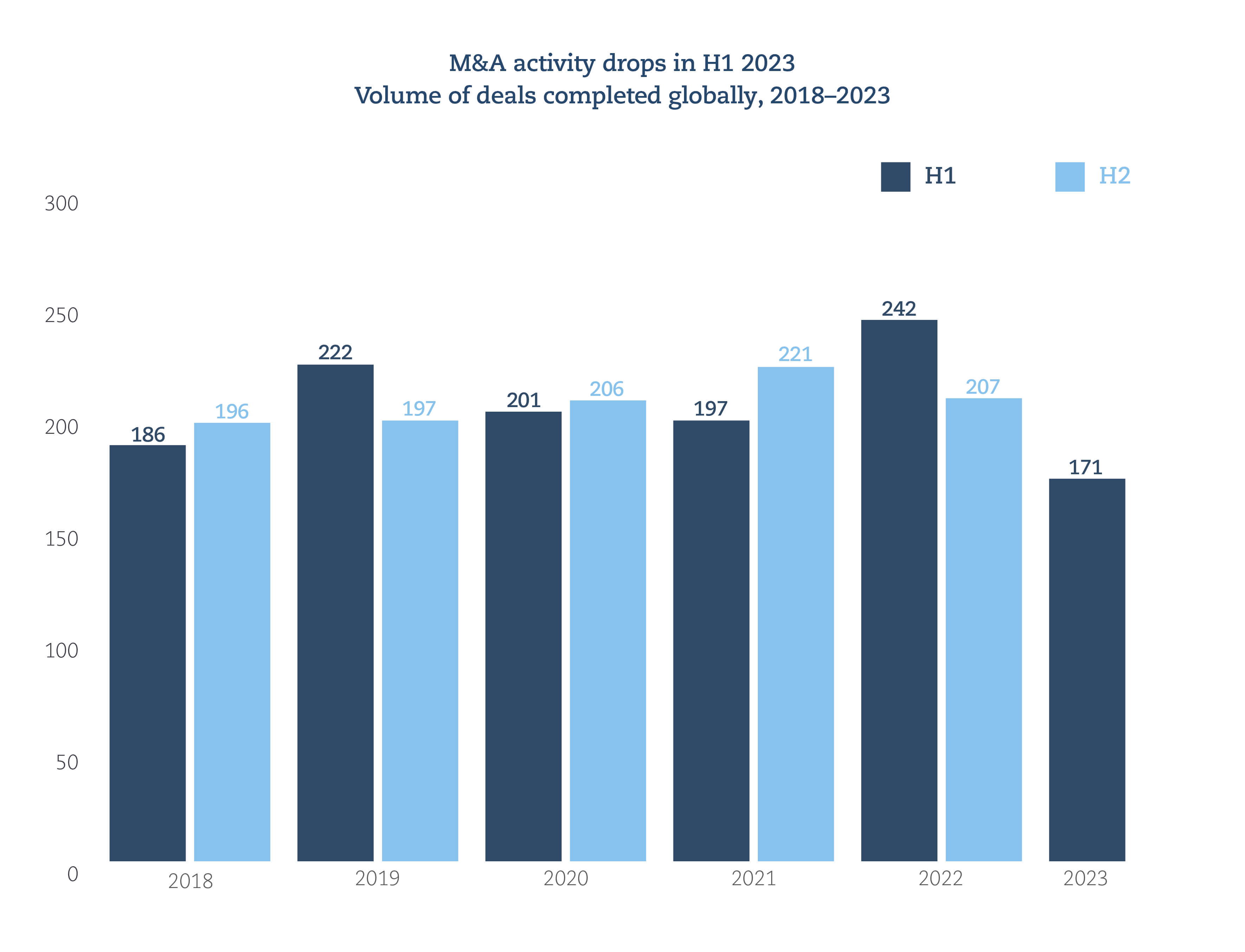

M&A activity decline and workforce landscape

The decline in merger and acquisition (M&A) activity within the insurance industry, observed since Q2 2022, has significant implications for the workforce. Historically, M&A transactions have played a pivotal role in shaping the insurance landscape, leading to job opportunities for professionals specializing in these areas.

Source: Clyde&Co

However, with the decline in M&A deals, many professionals in the workforce may find fewer opportunities in their traditional roles. As a result, industry leaders should adapt to the changing workforce dynamics by exploring new roles to retain employees and provide them with skill sets that align with the evolving needs of insurance companies.

InsurTech, AI and automation

KPMG’s 2020 CEO Outlook COVID special edition survey unveiled a striking trend within the insurance industry. An overwhelming 85% of insurance companies acknowledged that the pandemic catalyzed the advancement of their technological capabilities and ushered in the next generation of operating models. This drive toward technological transformation is significantly impacted by the expanding use of Artificial Intelligence (AI), which introduces challenges and opportunities.

With its potential to enhance operational efficiency, automate routine tasks, and elevate decision-making processes, AI is a pivotal force in the insurance landscape. However, realizing this potential necessitates a workforce with the requisite skills to effectively harness AI’s power. Organizations should take proactive steps to prepare their workforce for evolving roles and skill requirements, responding to an industry that is becoming increasingly automated.

Employees adaptation encompasses acquiring essential skills such as data analysis, machine learning, and AI implementation. These competencies are integral to remaining competitive in an insurance sector marked by the relentless march of automation.

Furthermore, the drive toward innovation is evident in the insurance industry’s increasing interest in adopting InsurTech solutions across multiple facets of the value chain, spanning from underwriting to claims processing.

Source: Damcogroup

Prominent players in the insurance industry, including Aegon, Allianz, Munich Re, Swiss Re, and Zurich, have embarked on the Blockchain Insurance Industry Initiative (B3i), a concerted effort to explore the potential of distributed ledger technologies in enhancing client services.

This transformative journey, underpinned by external technological adoption, reshapes workforce dynamics, emphasizes the importance of collaboration, and demands proficiency in seamlessly integrating external technology into existing operations. Insurance companies should bridge the gap between conventional insurance processes and modern technology solutions, calling for skilled professionals to facilitate this transition and foster collaboration among diverse teams.

Cloud Adoption, workforce flexibility, and cybersecurity

Many companies have transitioned to offering hybrid work models to their employees, demonstrating the insurance industry’s adaptability. Looking ahead, the next six months are poised to witness significant changes, with 72% of companies anticipating their employees will spend at least one day a week in the office.

This paradigm shift towards hybrid work arrangements is closely tied to the escalating adoption of cloud capabilities for core modernization within the insurance sector. The workforce dynamics of insurance companies are undergoing a substantial transformation, marked by the cultivation of greater flexibility in work arrangements. As insurance enterprises migrate to the cloud, they must seek professionals with expertise who can implement and manage cloud solutions.

The ability to harness cloud resources for scalability, data storage, and seamless remote work arrangements is becoming an indispensable aspect of workforce strategies in the industry.

Simultaneously, the growth of Artificial Intelligence (AI) within the insurance sector has heightened the significance of cybersecurity. Recognizing the potential vulnerabilities that accompany AI utilization, insurance companies are placing a heightened focus on employee awareness and training programs. These initiatives address cybersecurity challenges and fortify defenses against potential threats. In this landscape, cybersecurity professionals emerge as key figures entrusted with safeguarding sensitive data and ensuring the security of AI-driven systems. Their expertise and vigilance are instrumental in preserving the integrity of the insurance workforce and the industry.

Reskilling, upskilling, and employee experience

Within the insurance industry landscape, there’s a prevailing sense of optimism as 67% of insurance companies look forward to expanding their workforce in the coming year, demonstrating the sector’s continued growth. However, 89% of insurance agents leave their roles within three years, and 54% of the industry’s workforce embarked on new career journeys in 2021. While factors such as low wages and job dissatisfaction have traditionally been at the forefront of these workforce departures, newer motivations, such as feelings of undervaluation and career stagnation, have also emerged as driving forces. In this atmosphere of change and growth, insurance professionals find opportunities to reskill, upskill, and chart a more fulfilling career path.

For insurance professionals, the proactive acquisition of new skills has become the epitome of career advancement.

This journey hinges on a commitment to continuous learning, active participation in certification programs, and embracing professional development initiatives, collectively forming the foundation of the insurance sector’s workforce strategies. These strategies are designed to foster career growth and personal development.

Simultaneously, the insurance industry is on the cusp of transforming how it values and enhances the employee experience. This transformation is set to improve workforce satisfaction and productivity by creating more efficient and engaging work environments. Initiatives for enhancing the employee experience involve integrating digital tools for collaboration, streamlined training processes, and performance management. Insurers are wholeheartedly investing in prioritizing their employees’ well-being and engagement, aiming to build a highly motivated and productive workforce that aligns with the sector’s forward-looking objectives.

Sustainability and talent attraction

The insurance sector is transforming remarkably, redefining itself as a sustainability ambassador in response to evolving consumer preferences and societal needs. According to the 2023 Global Insurance Outlook:

- 79% of consumers actively consider insurers’ environmental commitments when purchasing.

- Additionally, 59% of consumers are now well-informed about companies’ corporate social responsibility efforts, reflecting a growing awareness of the broader impact of their choices.

- Perhaps most strikingly, 43% of consumers strongly desire to support companies prioritizing societal benefits, even if it means incurring higher costs.

This sweeping transformation isn’t confined to rhetoric; it extends deep into the industry’s core. It profoundly influences decision-making and strategic choices within the insurance landscape, prompting a reevaluation of long-standing practices and values.

Insurance companies seek unique talent, individuals whose personal convictions and professional aspirations align seamlessly with the industry’s newfound dedication to sustainability.

It’s no longer sufficient to provide financial protection merely; the insurance sector recognizes its potential to drive positive societal change. As a result, insurers seek candidates who share their enthusiasm for sustainability goals and have a genuine passion for making a meaningful impact on society. This shift underscores the imperative of assembling a workforce that understands and deeply resonates with the industry’s evolving values and unwavering commitment to sustainability.

In a world where societal and environmental concerns are paramount, the insurance industry’s shift towards sustainability is a strategic choice and a moral responsibility.

Innovative workforce solutions: Learning from industry leaders

As we explore the multifaceted challenges in the insurance industry’s workforce landscape, it’s essential to draw inspiration from diverse sectors where organizations have successfully navigated similar challenges with the help of HRForecast. Our experiences with industry leaders like Siemens, Merck, Deutsche Telekom AG, A1 Group, Stadtwerke Dusseldorf, and Deutsche Bahn offer valuable insights.

Siemens faced the need to evaluate future workforce trends, job roles, and skill profiles. Our collaboration with Siemens demonstrated the power of benchmarking against labor market competitors and future trends. By staying ahead of industry dynamics, Siemens has confidently embraced the future.

Merck embarked on an ambitious workforce planning strategy, necessitating a deep understanding of global labor market skills. HRForecast equipped Merck with the transparency required to make informed decisions and prepare for the evolving landscape of pharmaceuticals.

Deutsche Telekom AG aspired to provide its employees with an engaging learning experience. Our AI-driven learning journeys solution ensures their employees receive the best training and development programs, setting the stage for growth and innovation.

A1 Group leveraged people analytics to identify and bridge skill gaps, positioning themselves for the challenges and opportunities of the future.

Stadtwerke Dusseldorf harnessed the power of predictive modeling for HR challenges. Through our data-driven solution, they adeptly navigated the intricacies of workforce planning.

Deutsche Bahn partnered with HRForecast to identify new job requirement trends, aligning their strategy seamlessly with the future of work.

But our impact doesn’t end there. We’ve also collaborated with other distinguished organizations:

SAP SE: Together with HRForecast, SAP developed a labor market and competitor radar, providing valuable insights for their recruiting strategy and more.

Continental: Continental harnessed big data for better strategic skill management, preparing for the future of work with competent data analysis.

IAV GmbH: HRForecast’s labor market analysis assisted IAV GmbH in strategically establishing a new business location.

CMS: HRForecast designed a new workforce architecture for CMS, developing a strategic planning model and determining recruiting and development targets.

Continental Mexico: By deriving tailored, location-specific measures with HRForecast data analytics, Continental Mexico effectively reduced attrition.

Wacker Chemie AG: Wacker Chemie AG powered up its strategic recruiting and development decisions using market intelligence insights on future profiles and labor market analytics.

These stories highlight the transformative power of data analytics, AI-driven solutions, and strategic planning models. The insurance industry, facing its unique workforce challenges, can draw from these experiences. Insurance companies can build an agile and robust workforce prepared to excel in a rapidly evolving industry landscape by adopting innovative solutions and harnessing market intelligence. With HRForecast’s support, the insurance sector can overcome its challenges and secure a future of growth and sustainability. Contact us to explore how HRForecast can empower your organization with data-driven insights and strategic solutions.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810