Project Bora Bora: A transformative plan for Citigroup

Table of contents

Why is Citigroup cutting 20,000 jobs, including over 1,200 executives?

Citigroup’s ambitious restructuring strategy, Project Bora Bora, marks a key shift in the bank’s operating paradigm under CEO Jane Fraser. This transformational initiative is characterized by large-scale job cuts, simplifying management structure, exiting several consumer banking markets, and investing in technology upgrades. We’ll take a closer look at the ins and outs of the Bora Bora project, comparing it to industry standards. Ultimately, we will provide analysis and solutions to shed light on the strategic imperatives in the banking sector.

Background of the project Bora Bora

Project Bora Bora signifies a radical overhaul for Citi, entailing the possible reduction of 20,000 positions, strategic withdrawal from specific consumer banking markets, a streamlined management structure, and significant technology investments. These changes reflect Fraser’s vision to mold a more robust and agile Citi, poised to orient in the complexities of modern finance and reclaim its competitive edge. The initiative underscores a broader industry narrative of adaptation and recalibration in response to market demands and regulatory pressures.

Citi’s market exit and operational decisions

It’s not the first time Citi has decided to make big sacrifices. For example, in March 2023, Citi made a significant move by exiting consumer banking in India, transferring 3,200 employees to Axis Bank. This decision reflects the broader strategy under Project Bora Bora to streamline operations and exit less profitable or non-core markets. Such strategic decisions, while potentially beneficial for the bank’s focus and financial health, underscore the challenges of global banking operations and the need for careful management of transitions for both clients and employees.

Big layoffs examples

In principle, Citi is not the first company that dared to make such drastic cuts. Among the big companies were Amazon (cut 18,000 jobs), Google (cut 12,000 jobs), Microsoft (cut 10,000 jobs), Spotify (cut 1,599 jobs), Bosch (cut 1,200 jobs), Sony (cut 900 jobs) in 2023- beginning of 2024. These examples don’t indicate that big cuts are the only solution; they indicate a widespread restructuring environment. They highlight the need for firms to adapt to slower growth and changing market dynamics, with significant implications for employment and corporate strategy.

Below, we’ll review Morgan Stanley’s example.

Analysis of the restructuring effort

The ramifications of Project Bora Bora extend beyond mere numbers; they signify a profound transformation in Citi’s organizational ethos and market strategy. While the initiative aims to enhance profitability and market responsiveness, it has sparked internal debates and industry skepticism.

Alternative decision

On the contrary, Morgan Stanley’s strategic pivot under James Gorman emphasized wealth management and stable revenue streams, showcasing an alternative path to resilience and growth in 2017.

While both institutions aimed to bolster their market positions and ensure long-term growth, their chosen paths reflect differing priorities and operational philosophies.

Strategic focus:

- Citi (Project Bora Bora). Citi’s strategy under CEO Jane Fraser, characterized by substantial job cuts and market exits, signifies a sharp pivot towards operational efficiency and cost reduction. The initiative emphasizes streamlining the organizational structure, investing in technology, and focusing on core, high-margin business areas. This approach aims to enhance profitability and stock performance, yet it affects employee morale and corporate culture.

- Morgan Stanley (Under James Gorman). Conversely, under James Gorman, Morgan Stanley adopted a strategy that concentrated on diversifying income sources and stabilizing revenue through an expanded focus on wealth management. By investing in and growing this less volatile business sector, Morgan Stanley aimed to create a more resilient revenue base, less susceptible to the fluctuations of investment banking and trading sectors.

Operational impacts and employee morale:

- Citi: The extensive job reductions and structural overhauls at Citi likely led to significant internal uncertainty and morale challenges. While such changes can drive efficiency and financial improvement, they also require careful management of employee perceptions and engagement to prevent a decline in productivity or talent attrition.

- Morgan Stanley: Morgan Stanley’s emphasis on wealth management was less about drastic cost-cutting and more about growth and investment in a sector that promises steady, long-term returns. This approach presented a more stable employment environment and fostered better employee morale and retention, contributing to the company’s overall resilience.

Market perception and financial performance:

- Citi: Project Bora Bora aims to boost Citi’s market valuation and appeal to investors by demonstrating decisive action to improve margins and profitability. However, the success of such strategies often depends on their execution and the market’s response, particularly regarding how effectively the bank can translate these changes into sustained performance improvements.

- Morgan Stanley: Morgan Stanley’s strategy has been positively received regarding its financial stability and growth in wealth management. This approach has diversified Morgan Stanley’s revenue streams and enhanced its reputation for strategic foresight and prudent risk management, likely contributing to stronger investor confidence and stock performance.

Within Citi, the absence of a permanent investment banking head and upcoming changes in the equities and wealth management divisions signal a period of uncertainty and transition. Fraser’s approach —realigning senior banking roles and maintaining key personnel — aims to stabilize and stimulate market share expansion amidst these shifts.

Perspectives

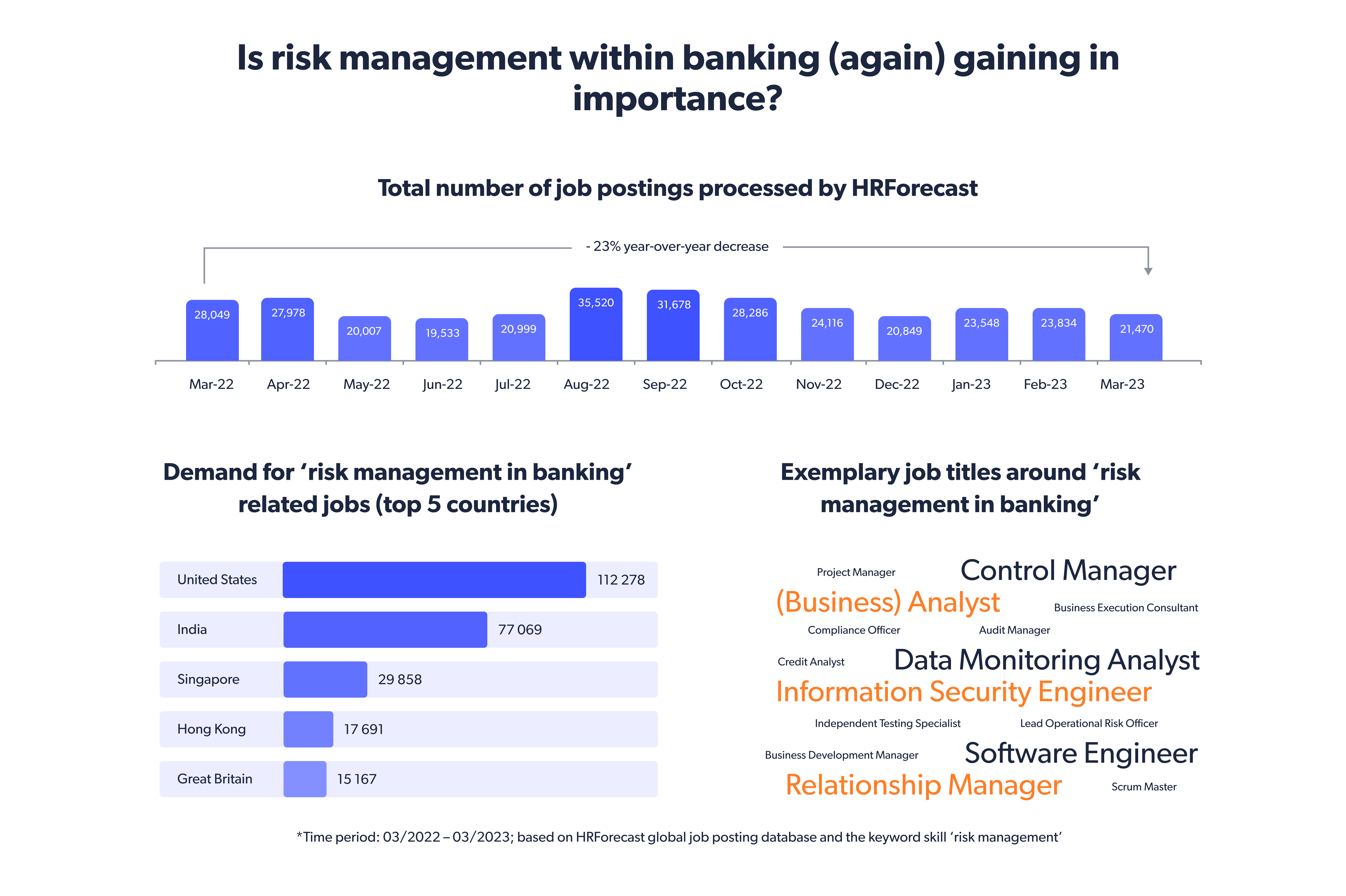

Considering the findings of HRForecast opens a critical view of labor market dynamics and strategic personnel management in the banking sector. For example, the analysis of risk management in banking outlined in March 2023 highlights the need for careful risk management and strategic workforce planning during turbulent times. HRForecast advocates for a holistic HR strategy that responds to organizational change, focusing on communication, talent retention, and adaptive leadership.

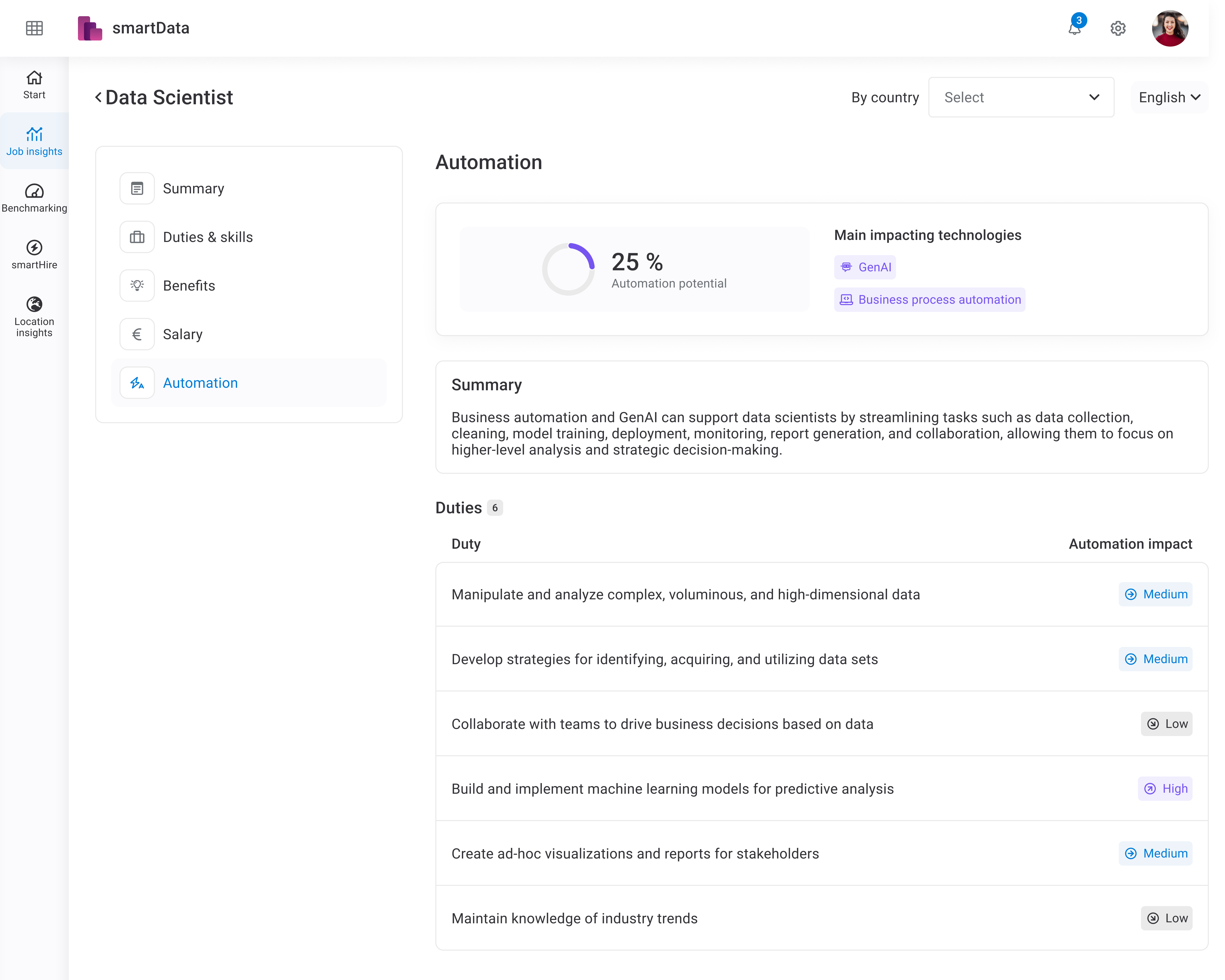

For a bank like Citi, this transformation is underscored by its significant investment in advanced technology infrastructure, a key step toward a more efficient and data-driven operating model. Integrating Generative AI (GenAI) technologies into Citi’s data processing system is particularly noteworthy. GenAI frees data professionals to spend more time on strategic analysis and innovation by automating routine tasks like data cleansing and preparation. This automation extends to predictive analytics, which enhance the bank’s predictive and decision-making capabilities and are critical to risk management and customer engagement.

Source: HRForecast

Strategic alternatives and recommendations

While Citi focuses on profitability, integrating technologies such as GenAI opens up the opportunity to mitigate significant job cuts while offering a more sustainable approach to restructuring. Emphasis on incremental technology adoption, market orientation, and employee engagement can shape a more holistic strategy, improving Citi’s operational efficiency without compromising workforce stability. This approach aligns with the broader need for strategic reskilling and workforce optimization, where automation serves as a cost-cutting solution and a catalyst for organizational evolution and talent development.

HRForecast automation insights can soften job cuts and exits through strategic, phased changes.

- Automation potential across jobs. HRForecast has analyzed over 4,500 jobs, identifying specific automation percentages, like how lawn mowing in gardening can be automated by 10-20%.

- Department-specific automation. Different departments can leverage automation to varying extents, offering nuanced integration strategies.

- Workforce optimization. Detailed automation data aids in addressing workforce shortages, demographic shifts, and strategic hiring, pinpointing areas where automation can replace or augment human efforts.

- Strategic reskilling. Identifying roles at risk due to automation enables strategic upskilling-reskilling-cross-skilling or transitioning employees to areas less susceptible to technological displacement.

Adopt these insights if you want to refine your strategies to balance market participation with technological integration, focusing on sustainability and employee retention.

Source: HRForecast

Conclusion

When we reflect on the Citi Bora Bora project and its implications in the broader context of industry trends and strategic decision-making, it’s clear that dealing with such transformative changes requires deep understanding, strategic foresight, and adaptive leadership. The parallels drawn between Citi’s restructuring and similar trends across industries highlight the universal challenges and opportunities that come with organizational change and market adaptation.

Whether you’re dealing with a corporate restructuring, looking to improve organizational resilience, or seeking to understand broader industry trends, tailored advice and strategic insights can make a big difference in decision-making and outcomes.

If you want to gain a deeper understanding of practical strategies and solutions tailored to your organization’s unique context, schedule a call with our specialists to discuss your strategic challenges and opportunities in detail.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810