Workforce challenges in the pharmaceutical & chemical industries in Europe

Chemical and pharmaceutical products are used everywhere, from manufacturing to makeup, food production to medicine. The chemical and pharmaceutical industries are closely linked, and the borders between them are becoming increasingly blurred. In addition to creating value-added products, the global pharmaceutical and chemical industries are responsible for employing approximately 20 million people.

This post focuses on current employment trends and workforce challenges in Europe’s chemical and pharmaceutical industries.

Looking back at workforce insights and challenges in the European pharma & chemical industries in 2022

Most positions in the chemical and pharmaceutical industries require a high level of education and training. Consequently, wages in these industries are generally higher than in other manufacturing industries. At the same time, several work challenges were reported in the chemical and pharmaceutical industries in 2022. Here are some of the most tangible.

Widening skills gaps and talent shortages

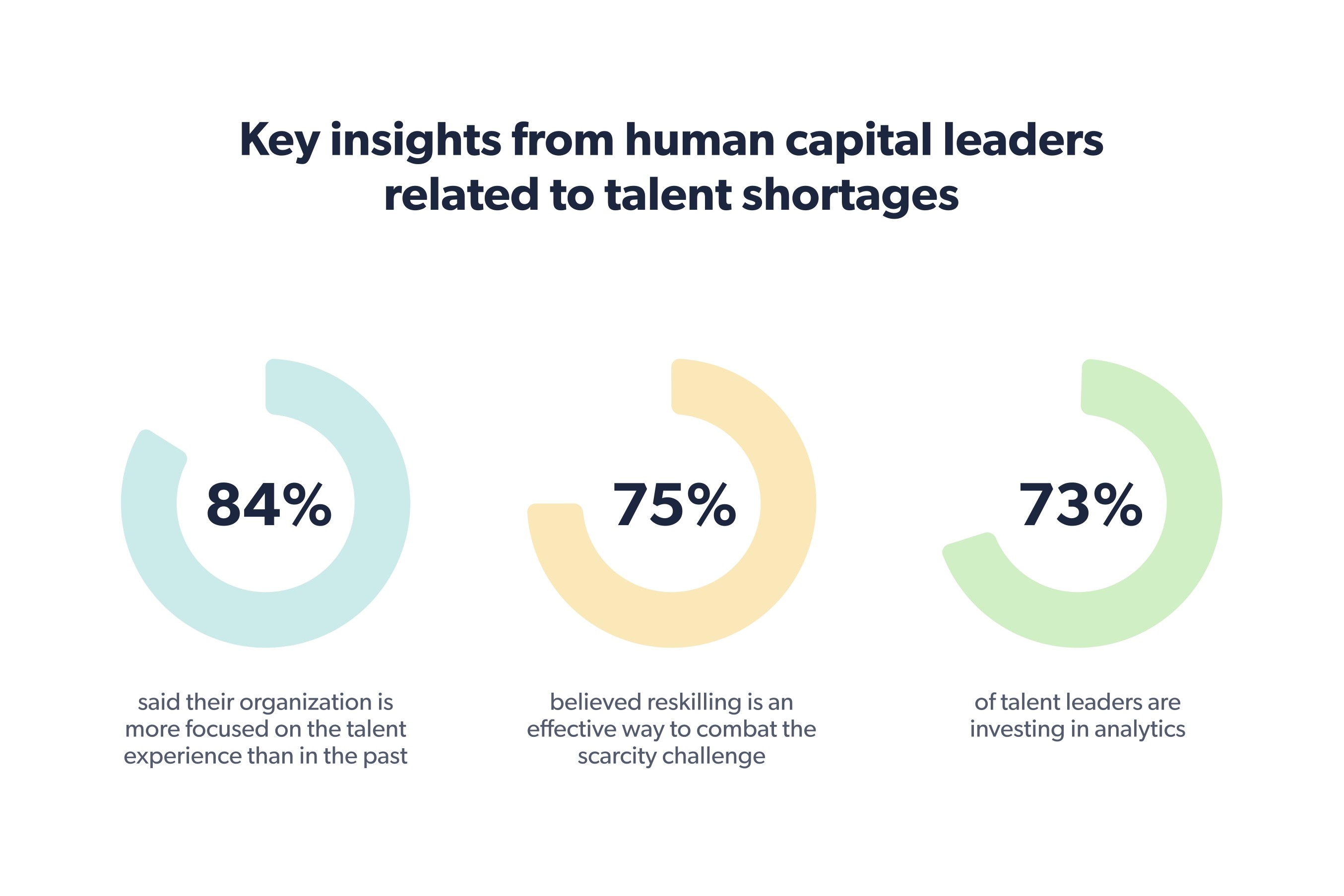

Shortages of employees with the scientific, technical, and productive skills required by the chemical and pharmaceutical industries were highlighted. According to Randstad Sourceright’s 2022 life sciences and pharma Talent Trends report, a third of C-suite and human capital leaders in the life sciences and pharmaceuticals sector said talent scarcity was a central pain point for the sector, which was hiring extensively last year. The report further highlights the below key points related to talent shortages.

Source: Randstadsourceright

Need for structured training and upskilling programs for employees

Post-pandemic, the pharmaceutical industry witnessed a significant acceleration in digital transformation to improve quality and productivity by deploying modern technologies such as artificial intelligence (AI), machine learning (ML), cloud computing, and robotic process automation (RPA).

While employers were confident that the current education and training market could deliver the skills they needed to transition to a digital and green future, an estimated 80% of the UK’s 2030 workforce have already left formal education. As the pharmaceutical sectorThat’s why the need has arisen to

Need to foster and retain employees

Staffing is a significant concern for the pharmaceutical industry, as the European pharmaceutical market is expected to expand at a CAGR of 5.4% between 2021 and 2028 and is expected to reach US$432.12 billion by 2028. This is faster than the average expected growth for all other industries. As technology and life sciences are converging, there has been an increased focus on recruiting professionals with the expertise to deliver tech-enabled solutions.

The reason why the vacancy rate remained high in 2022 is that recruitment and retention are uniquely challenging in the pharmaceutical and chemical industry. For some time, the industry has recognized the need to retain employees, but this does not necessarily mean that significant efforts are being made. This creates an immediate and rising need for talent management, an active retention strategy, and a clear leadership succession plan.

Mergers and acquisitions

Merger and acquisition activity in Europe’s chemical and pharmaceutical industries was slow in the first half of 2022 as companies paused to watch the impact of the war in Ukraine, rising interest rates, and a possible recession. After the first quarter of 2022, the M&A megatrend started with a bang.

However, mergers and acquisitions impact employees, especially those of the acquired company, giving rise to feelings of anxiousness and nervousness that affect employees’ emotional resilience. Identifying the possible impacts of business amalgamation on employees is crucial.

In one of our previous articles, we highlighted the role of HR before and after mergers and acquisitions to ensure that employees feel secure about their jobs and the work environment to avoid stress and culture shock.

Workforce trends and opportunities 2023 has in store for the pharma & chemical industries in Europe

With the chemical and pharmaceutical industries becoming a priority for many governments, both industries seem to have a bright future. But on the flip side, there are several factors including workforce challenges, consumer attitudes, raw material availability, affordability, and governmental policies that might only partially favor these industries and may in fact challenge their growth.

Below, we highlight several critical trends and opportunities in 2023 for the chemical and pharmaceutical industries as well as steps companies can take to combat associated future workforce challenges.

HR demand forecasting for efficient decision-making

One of the biggest challenges companies in the pharmaceutical and chemical industries face is to devise reliable employee requirement forecasts and enhance productivity. This is largely a challenge due to inefficient HR demand forecasting, which is essential for pharma and chemical companies to stay ahead of the competition and match labor supply to demand.

Additionally, ensuring that critical vacancies are filled in the desired time frame and that job transitions are seamless poses a big challenge to pharma and chemical companies. Inconsistencies and errors in the HR demand forecasting process are significant hurdles that companies face. An efficient market intelligence solution can enable better workforce demand forecasting by leveraging proprietary analytics techniques and effectively combining available internal and external data to meet this challenge.

An excellent example of using market intelligence to forecast the future workforce is when Merck approached HRForecast to solve the challenges they faced with competitor benchmarking, future workforce insights, and future job profiles. Read how HRForecast helped Merck overcome their challenges with market intelligence analysis.

Training and development activities to ensure longevity and survival

The pharma and chemical industry job market is characterized by talent shortages. The onus is on businesses to provide their workforce with attractive job opportunities. With vacancies in abundance, candidates want to know what their potential new employer can offer them rather than the other way round. Businesses must offer the chance for candidates to receive specialist training, which will simultaneously attract new candidates and upskill a generation of talent.

Mobile-friendly learning will make it easier for new information to be disseminated to staff more quickly — even in real time. This is especially important for customer-facing staff on the front lines of the pharmaceutical sector, as they can be updated on new procedures, security alerts, compliance changes, or information on the production of new drugs almost instantly.

Training current employees who already know the business, understand its priorities, and are familiar with the inner workings means less time spent onboarding new talent. It also provides the flexibility to better align workforce skills with market demands.

Align training and development opportunities with future demand

Explore the future in-demand job roles in the pharma and chemical industries so you can offer training opportunities to employees that ensure success rather than having to guess what they should do next.

Investment in an internal talent marketplace to continue progress

One of the many challenges facing pharmaceutical and chemical industry employers today centers around identifying and retaining the best talent. The competition is fierce.

Research from McKinsey shows that life sciences companies report an 80% mismatch in skills; given this, providing employees with the training to meet rapidly shifting needs will be more important than ever.

With the traditional ways of working era widely regarded as being over, companies today are focusing on internal talent mobility, or identifying current employees who can be developed to assume new roles that would otherwise be hard to fill.

By upskilling and reskilling the current workforce with the right knowledge and expertise to fill those roles, companies can avoid the struggles of competing for an increasingly limited pool of pharma talent. At the same time, developing an internal talent marketplace platform with progressive career paths is a great way to retain employees and show them they’re valuable to the organization.

Focus on the talent experience to keep employees engaged

Upskilling and reskilling are only part of creating an internal talent pool that can be mobilized for new and different roles. Providing an exceptional talent experience will keep people engaged and motivated as they advance in their careers.

Pharmaceutical companies already have a built-in advantage, offering employees the chance to be part of a mission to help society through their innovations. While sharing a company’s purpose is often critical for employees to be satisfied on the job, there is much more employers can do to create a workplace where employees want to stay.

Factors like offering flexible work arrangements, increasing compensation and fringe benefits, and focusing on employee well-being can all contribute to a rewarding talent experience that keeps employees engaged and retained. Companies can also think outside the box with their offerings to truly give candidates what they want and what might be unavailable from other employers, such as infertility treatment, wellness coaching, or daycare.

Want us to give you the prescription for a future-ready workforce?

The pharmaceutical and chemical industries are making a huge contribution to powering growth in the business landscape, as evidenced by news stories in 2022:

AstraZeneca’s 2025 expansion plan through mergers and acquisitions

The chemical industry maintains itself in emerging economies with 1.1 million direct jobs and 2.9 million indirect jobs while battling with

Linde, BASF, and SABIC to construct a pilot plant in September that will be the world’s first large-scale electrically heated steam cracker furnace

Lyondellbasell’s Houston Oil refinery shutdown to affect approximately 550 employees

GSK moves operations to third party in Kenya

What remains common for companies in the pharmaceutical and chemical industries is that not finding needed talent can jeopardize progress in the face of enormous potential. Understanding your current workforce can be key to meeting critical skills gaps and getting work done. Contact us to get more insights into how you can combine your employees’ talent experience, build an agile workforce with different talent groups, and form an effective strategy to overcome talent scarcity and be better prepared to meet the changing workforce needs of the future.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810